FOR IMMEDIATE RELEASE

March 22, 2022 – TORONTO, ONTARIO, CANADA and GATINEAU, QUÉBEC, CANADA – Converge Technology Solutions Corp. (“Converge” or “the Company”) (TSX:CTS) (FSE:0ZB) (OTCQX:CTSDF) is pleased to provide its financial results for the three and twelve month period ended December 31, 2021. All figures are in Canadian dollars unless otherwise stated.

For the three-month period ended December 31, 2021 (“Q4-2021”) and full year 2021 (“FY21”), Converge reports the following financial highlights:

- Q4-2021 net revenue increased 74% over the same quarter last year (“Q4-2020”) to $505.0 million

- Q4-2021 gross profit increased 63% over Q4-2020 to $115.9 million

- Q4-2021 Adjusted EBITDA[1] increased 48% to $34.7 million from $23.4 million in Q4-2020

- FY21 net revenue increased 61% to $1,527.8 billion compared to last year (“FY20”)

- FY21 gross profit increased 48% to $345.7 million from FY20

- FY21 Adjusted EBITDA1 increased 55% to $94.0 million from FY20

- For Q4-2021, the Company generated Adjusted Free Cashflow and Adjusted Free Cash Flow Conversion1 of $29.0 million and 84%, respectively, increasing from $17.5 million and 75% in Q4-2020

- Organic growth for FY211 was approximately 9.6%

- Reported Adjusted EPS1 of $0.12 per share for Q4-2021, and $0.35 per share for FY21, increasing from $0.12 per share and $0.27 per share for Q4-2020 and FY20, respectively

- Bookings backlog[2] increased to approximately $350 million in Q4 2021 compared to approximately $250 million in Q3 2021

- Closed three bought deal financings in FY21 for cumulative gross proceeds of approximately $518.0 million in equity financings, which on a price per-share basis, increased from $4.85 in January 2021 to $10.55 in September 2021

Q4-2021 & FY21 Business Highlights

- Completed nine acquisitions throughout 2021, including REDNET GmbH, an IT solutions provider focused on serving clients in Germany’s public sector, and serves as a platform acquisition in Europe for further growth

- Enhanced the analytics practice and managed services offerings, and deepened customer relationships through key North American acquisitions, including CarpeDatum LLC, Accudata Systems, Inc., Dasher Technologies, Inc., ExactlyIT, Inc., Vicom Infinity and Infinity Systems Software, Inc., and LPA Software Solutions, LLC

- In response to customer demand, we expanded our cybersecurity capabilities across identity and data protection, risk and compliance, security intelligence and analytics, and threat assessments, partnering with a few of our key strategic partners

- Achieved 95 net new logos in Q421 resulting in nearly 400 new logos throughout the fiscal year

- Formed majority owned cybersecurity-focused SaaS entity, Portage CyberTech Inc. and closed a $35 million non-brokered private placement

- As at the end of FY21, we have integrated over 70% of our companies onto our platform and we continue to integrate our sales organization by region and build our international platform of over 700 technical resources to better serve our customers for advanced analytics, cybersecurity, cloud, and managed services

- Announced a new Google Cloud Marketplace solution, Converge Enterprise Cloud – IBM Power for Google Cloud (IP4G) allowing Converge and Google Cloud the ability to provide infrastructure-as-a-service solution to clients across North America and Europe

- Expanded ABL Credit Facility from $190 million to $300 million in December 2021 in an agreement with syndicate of banks led by CIBC, and added J.P. Morgan Chase & Co. to the Company’s syndicate of banks

- Graduated to the TSX from the TSX Venture Exchange in Q1 2021 and added to the S&P/TSX Composite Index in Q3 2021

Subsequent to Quarter in 2022

- Appointed John Teltsch to the Company’s Senior Leadership team as Chief Revenue Officer, who will work closely with President Greg Berard on profit alignment and global strategy

- Converge completed additional acquisitions of Paragon Development Systems, Inc., a Wisconsin-based digital transformation specialist, and added a complementary European acquisition in Visucom GmbH, a Germany-based supplier in media devices within the education and public sector

- Portage CyberTech Inc. concluded Phase 1 of its growth strategy upon completing the acquisition of 1CRM Systems Corp. a Canadian SaaS-based software provider

- CRN has named Converge to its Managed Service Provider (MSP) 500 list in the Elite 150 category for 2022 and featured Converge on its 2022 Tech Elite 250 list recognizing the highest level of technical certifications from leading technology suppliers

“The Company has added strategic acquisitions throughout the year expanding on high impact solution areas such as data analytics, AI, cloud, and cybersecurity while simultaneously rolling out various managed services and expanding offerings into Europe with the platform acquisition of REDNET GmbH,” stated Shaun Maine, CEO of Converge. “To achieve the net new logos and organic growth the Company has reported, while managing backlog and inventory challenges, really speaks to the level of commitment and success our employees strive for and reinforces the strength of our corporate culture. Additionally, we have rolled out various committees that are focused on wellness and inclusion initiatives, to progress employee satisfaction and awareness. I believe it is safe to say that Converge has advanced its business strategy beyond expectations for 2021 and will continue to do so throughout 2022, as we leverage our industry leaders including Doris Albiez, Thomas Volk, and John Teltsch who provide invaluable leadership to our family of companies and overall global strategy.”

Conference Call Details:

Date: Wednesday, March 23rd, 2022

Time: 8:00 AM Eastern Time

Participant Dial-in Numbers:

Webcast Link – https://edge.media-server.com/mmc/p/jwxb2nux

Toll Free – North America (+1) 888 708 0720

Toll Free – International (929) 517 9011

Germany – 0800 181 5287

United Kingdom – 0800 028 8438

Conference ID: 5783149

Recording Playback Numbers:

Toll Free – (855) 859 2056

Alternative Number – (404) 537 3406

Conference ID: 5783149

Expiry Date: March 30th, 2022

A live audio webcast and archive of the conference call will be available by visiting the Company’s website at https://convergetp.com/investor-relations/. Please connect at least 15 minutes prior to the conference call to ensure time for any software download that may be needed to hear the webcast.

About Converge

Converge Technology Solutions Corp. is a software-enabled IT & Cloud Solutions provider focused on delivering industry-leading solutions and services. Converge’s global solution approach delivers advanced analytics, application modernization, cloud, cybersecurity, digital infrastructure, and digital workplace offerings to clients across various industries. The Company supports these solutions with advisory, implementation, and managed services expertise across all major IT vendors in the marketplace. This multi-faceted approach enables Converge to address the unique business and technology requirements for all clients in the public and private sectors. For more information, visit convergetp.com.

For further information contact:

Converge Technology Solutions Corp.

Email: [email protected]

Phone: 416-360-1495

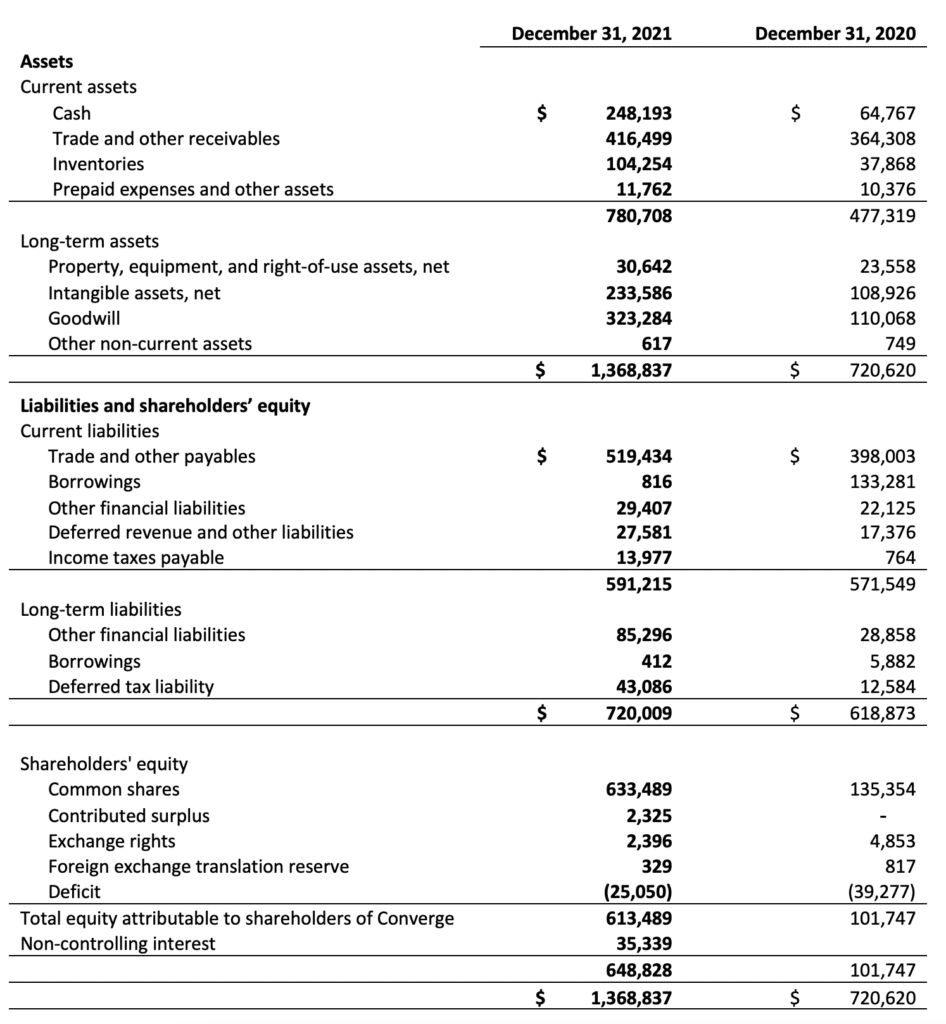

Summary of Consolidated Statements of Financial Position

(expressed in thousands of Canadian dollars)

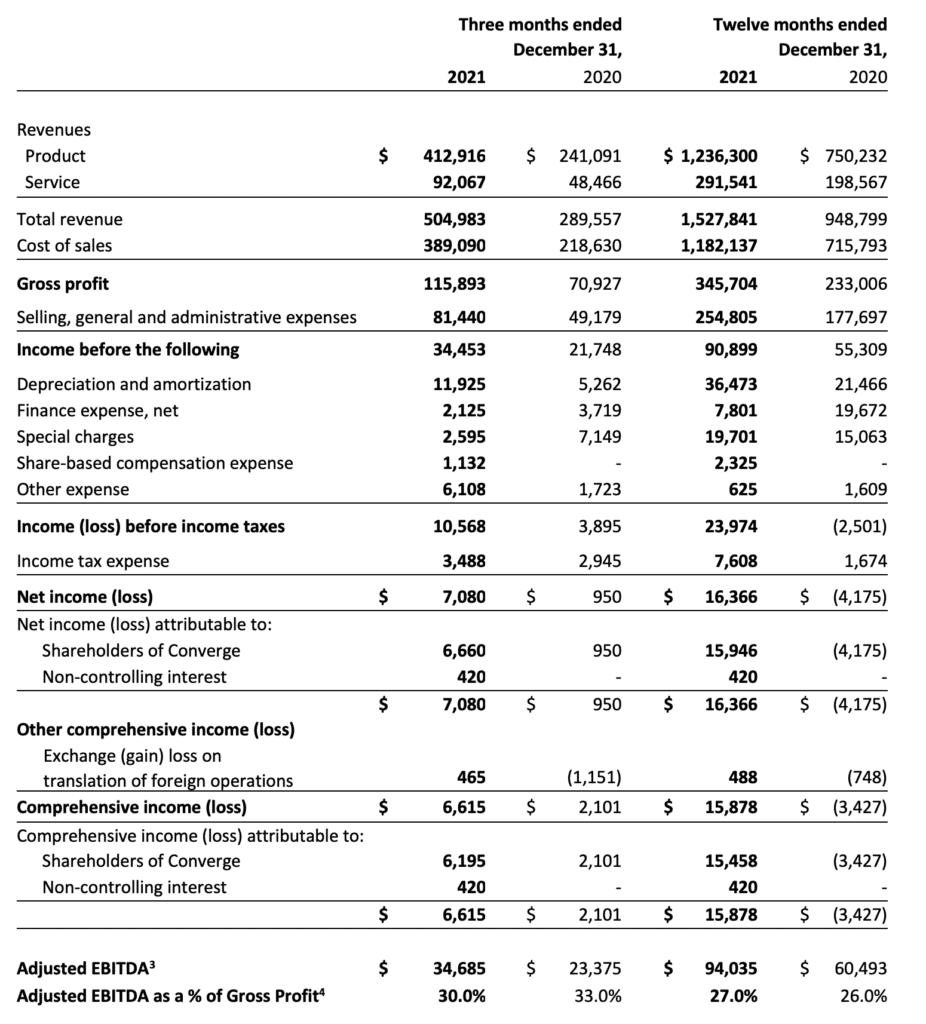

Summary of Consolidated Statements of Income (Loss) and Comprehensive Income (Loss)

(expressed in thousands of Canadian dollars)

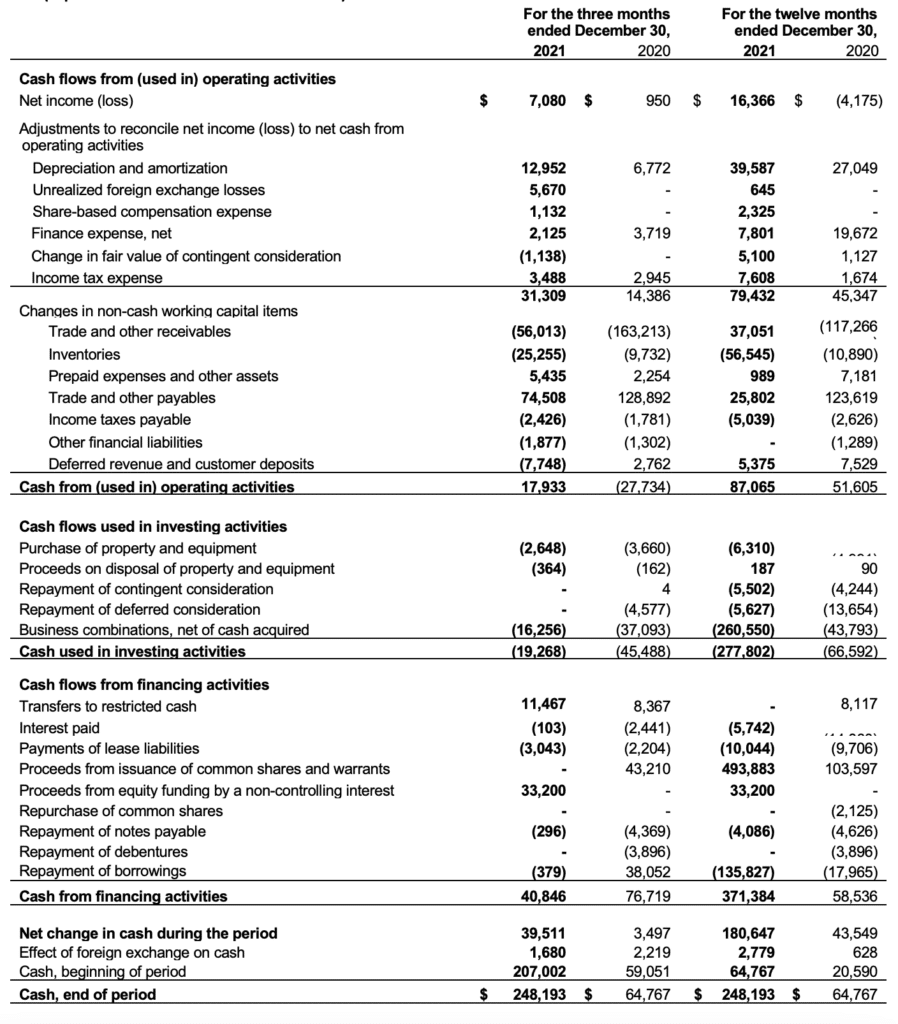

Summary of Consolidated Statements of Cash Flows

(expressed in thousands of Canadian dollars)

Non-IFRS Financial Measures

This news release refers to certain performance indicators including “Adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA)”, “Adjusted Free Cash Flow”, “Adjusted Free Cash Flow Conversion”, “Adjusted Net Income (Loss)” and “Adjusted Earnings per Share”, “Gross Revenue”, and “Organic Growth” which are not recognized under IFRS and do not have any standardized meaning prescribed by IFRS. Converge’s method of calculating such non-IFRS measures and ratios may differ from methods used by other companies and therefore may not be comparable to similar measures presented by other companies. Management believes that these measures are useful to most shareholders, creditors, and other stakeholders in analyzing the Company’s operating results, and can highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS financial measures. The Company also believes that securities analysts, investors and other interested parties frequently use non-IFRS measures in the evaluation of issuers.

Management also uses non-IFRS measures and ratios in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets and assess the ability to meet capital expenditure and working capital requirements. These non-IFRS financial measures and ratios are furnished to provide additional information and should not be considered in isolation or as an alternative to the consolidated income (loss) or any other measure of performance under IFRS. Investors are encouraged to review the Company’s financial statements and disclosures in their entirety and are cautioned not to put undue reliance on non-IFRS measures and ratios and view them in conjunction with the most comparable IFRS financial measures.

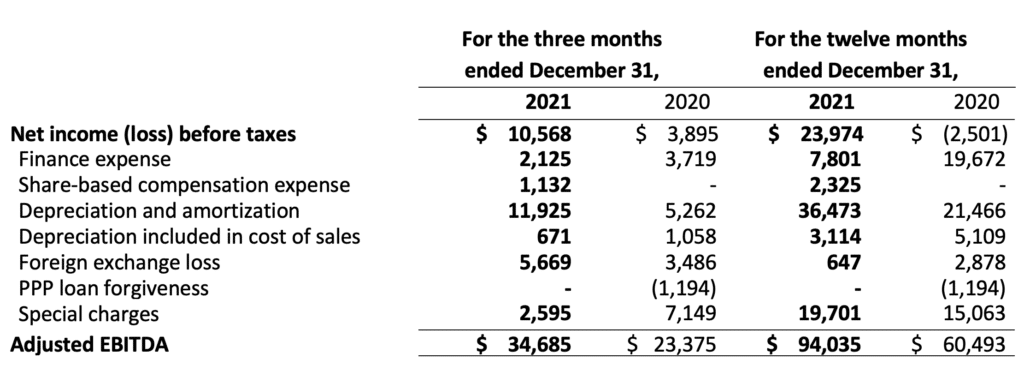

Adjusted EBITDA

Adjusted EBITDA represents net income (loss) or income adjusted to exclude amortization, depreciation, interest expense and finance costs, foreign exchange gains and losses, share-based compensation expense, income tax expense, and special charges. Special charges consist primarily of restructuring related expenses for employee terminations, lease terminations, and restructuring of acquired companies, as well as certain legal fees or provisions related to acquired companies. From time to time, it may also include adjustments in the fair value of contingent consideration, and other such non-recurring costs related to restructuring, financing, and acquisitions.

Adjusted EBITDA is not a recognized, defined, or standardized measure under IFRS. The Company’s definition of Adjusted EBITDA will likely differ from that used by other companies and therefore comparability may be limited. Adjusted EBITDA should not be considered a substitute for or in isolation from measures prepared in accordance with IFRS.

The Company has reconciled Adjusted EBITDA to the most comparable IFRS financial measure as follows:

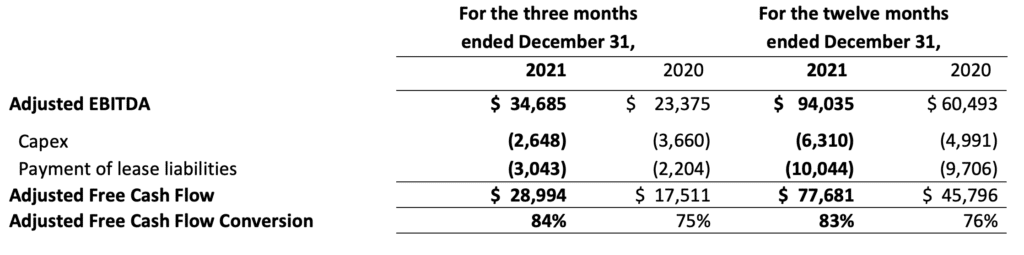

Adjusted Free Cash Flow and Adjusted Free Cash Flow Conversion

The Company calculates Adjusted Free Cash Flow as Adjusted EBITDA less: (i) capital expenditures (“Capex”) and (ii) lease payments relating to the IFRS 16 lease liability (“IFRS 16 Lease Liability”). Capex and IFRS 16 Lease Liability cash outflows are found in the cash flows from investing activities and cash flows from financing activities sections of the Company’s consolidated statements of cash flows, respectively. Adjusted Free Cash Flow is a useful measure that allows the Company to primarily identify how much pre-tax cash is available for continued investment in the business and for the Company’s growth by acquisition strategy.

Management also believes that Adjusted EBITDA is a good proxy for cash generation and as such, Adjusted Free Cash Flow Conversion is a useful metric that demonstrates that the rate at which the Company can convert Adjusted EBITDA to cash.

The following table provides a calculation for Adjusted Cash Flow and Adjusted Cash Flow Conversion for the Q4-2021 and FY21:

Adjusted EBITDA as a % of Gross Profit

The Company believes that Adjusted EBITDA as a % of Gross Profit is a useful measure of the Company’s operating efficiency and profitability. This is calculated by dividing Adjusted EBITDA by gross profit.

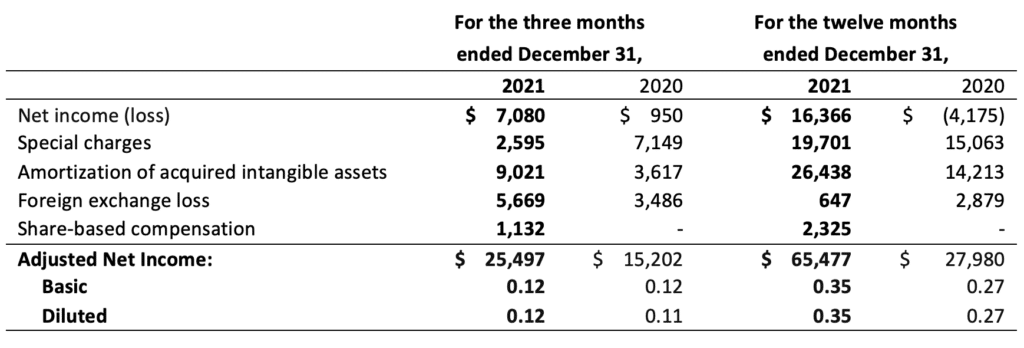

Adjusted Net Income (Loss) and Adjusted Earnings per Share (“EPS”)

Adjusted Net Income (Loss) represents net income (loss) adjusted to exclude special charges, amortization of acquired intangible assets, and share-based compensation. The Company believes that Adjusted Net Income (Loss) is a more useful measure than net income (loss) as it excludes the impact of one-time, non-cash and/or non-recurring items that are not reflective of Converge’s underlying business performance. Adjusted EPS is calculated by dividing Adjusted Net Income (Loss) by the total weighted average shares outstanding on a basic and diluted basis.

The Company has provided a reconciliation to the most comparable IFRS financial measure as follows:

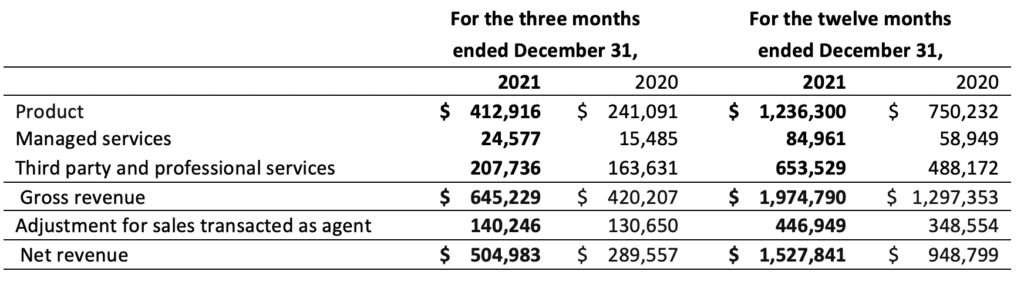

Gross revenue and Gross revenue for organic growth

Gross revenue, which is a non-IFRS measurement, reflects the gross amount billed to customers, adjusted for amounts deferred or accrued. The Company believes gross revenue is a useful alternative financial metric to net revenue, the IFRS measure, as it better reflects volume fluctuations as compared to net revenue. Under the applicable IFRS 15 ‘principal vs agent’ guidance, the principal records revenue on a gross basis and the agent records commission on a net basis. In transactions where Converge is acting as an agent between the customer and the vendor, net revenue is calculated by reducing gross revenue by the cost of sale amount. Gross revenue for organic growth is calculated as i) the actual gross revenue for companies owned by Converge for at least three months that is included in the Company’s financial results for the year then ended, plus ii) for those acquisitions that occurred after January 1 and that have been under Converge ownership for at least three months, the pro forma gross revenue contribution had they been owned for the full fiscal year.

The Company has provided a reconciliation of gross revenue to net revenue, which is the most comparable IFRS financial measure, as follows:

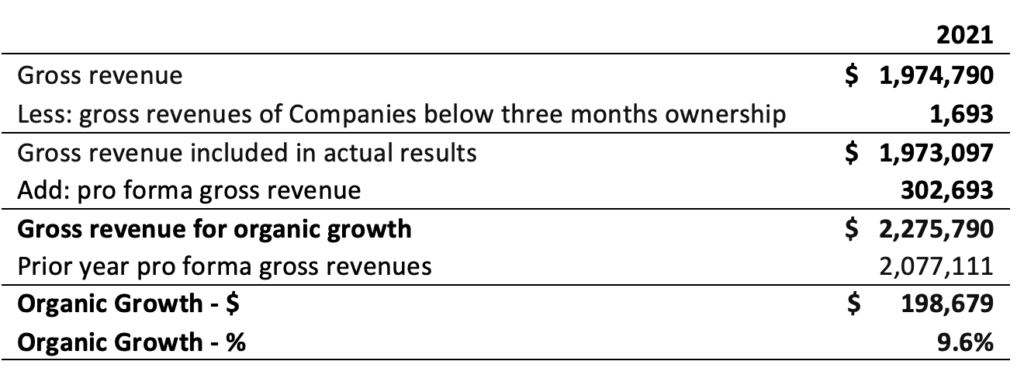

The Company measures organic growth on an annual basis, at the gross revenue level, and includes companies that Converge has owned for at least three months. Once a company is acquired, there is lead time required to integrate and regionalize the acquired work force, align rebate programs, and begin to execute on cross-selling opportunities. Management believes that three months provides a good representation of the acquisition under Converge ownership and can begin to evaluate the acquired company from an organic growth standpoint. Organic growth is calculated by deducting prior year pro forma gross revenues from current year gross revenue for organic growth. Organic growth % is calculated by dividing organic growth by prior year pro forma gross revenues, as follows:

The following table calculates organic growth for FY21:

Forward-Looking Information

This press release contains certain “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities legislation regarding Converge and its business. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected” “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”. “estimates”, “believes” or intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while the Company considers reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Except as required by law, Converge assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change. The reader is cautioned not to place undue reliance on forward-looking statements.

For a detailed description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company’s filings available on SEDAR under the Company’s profile at www.sedar.com including its most recent Annual Information Form, its Management Discussion and Analysis and its Annual and Quarterly Financial Statements.

[1] This is a Non-IFRS measure (including non-IFRS ratio) and not a recognized, defined or a standardized measure under IFRS. See the Non-IFRS Financial Measures section of this news release for definitions, uses and a reconciliation of historical non-IFRS financial measures to the most directly comparable IFRS financial measures.

[2] Bookings backlog is calculated as purchase orders received from customers not yet delivered at the end of the fiscal period

[3] Non-IFRS measure. See “Adjusted EBITDA” under the Non-IFRS Financial Measures section of this news release.

[4] Non-IFRS measure. See “Adjusted EBITDA as a % of Gross Profit” under the Non-IFRS Financial Measures section of this news release.